Page 3 - Wealth Adviser Newsletter March 2025

P. 3

ISSUE 107

MARCH 2025

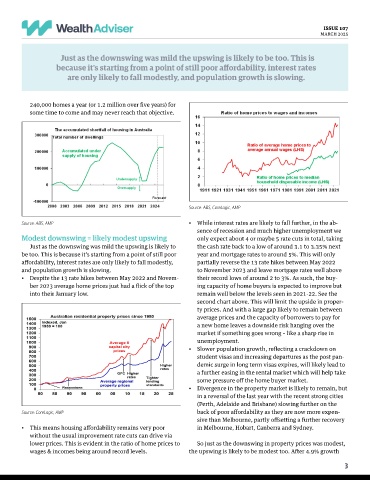

Just as the downswing was mild the upswing is likely to be too. This is

because it’s starting from a point of still poor affordability, interest rates

are only likely to fall modestly, and population growth is slowing.

240,000 homes a year (or 1.2 million over five years) for

some time to come and may never reach that objective.

Source: ABS, CoreLogic, AMP

Source: ABS, AMP • While interest rates are likely to fall further, in the ab-

sence of recession and much higher unemployment we

Modest downswing = likely modest upswing only expect about 4 or maybe 5 rate cuts in total, taking

Just as the downswing was mild the upswing is likely to the cash rate back to a low of around 3.1 to 3.35% next

be too. This is because it’s starting from a point of still poor year and mortgage rates to around 5%. This will only

affordability, interest rates are only likely to fall modestly, partially reverse the 13 rate hikes between May 2022

and population growth is slowing. to November 2023 and leave mortgage rates well above

• Despite the 13 rate hikes between May 2022 and Novem- their record lows of around 2 to 3%. As such, the buy-

ber 2023 average home prices just had a flick of the top ing capacity of home buyers is expected to improve but

into their January low. remain well below the levels seen in 2021-22. See the

second chart above. This will limit the upside in proper-

ty prices. And with a large gap likely to remain between

average prices and the capacity of borrowers to pay for

a new home leaves a downside risk hanging over the

market if something goes wrong – like a sharp rise in

unemployment.

• Slower population growth, reflecting a crackdown on

student visas and increasing departures as the post pan-

demic surge in long term visas expires, will likely lead to

a further easing in the rental market which will help take

some pressure off the home buyer market.

• Divergence in the property market is likely to remain, but

in a reversal of the last year with the recent strong cities

(Perth, Adelaide and Brisbane) slowing further on the

Source: CoreLogic, AMP back of poor affordability as they are now more expen-

sive than Melbourne, partly offsetting a further recovery

• This means housing affordability remains very poor in Melbourne, Hobart, Canberra and Sydney.

without the usual improvement rate cuts can drive via

lower prices. This is evident in the ratio of home prices to So just as the downswing in property prices was modest,

wages & incomes being around record levels. the upswing is likely to be modest too. After 4.9% growth

3