Page 2 - Wealth Adviser Newsletter March 2025

P. 2

ISSUE 107

MARCH 2025

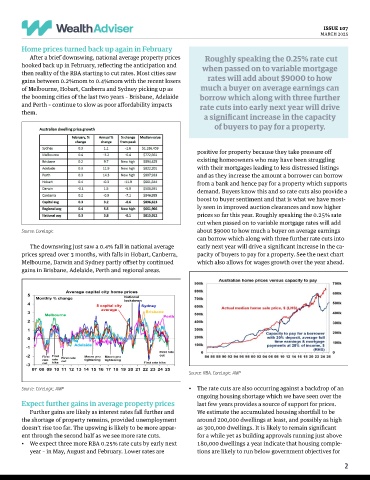

Home prices turned back up again in February

After a brief downswing, national average property prices Roughly speaking the 0.25% rate cut

hooked back up in February, reflecting the anticipation and when passed on to variable mortgage

then reality of the RBA starting to cut rates. Most cities saw

gains between 0.2%mom to 0.4%mom with the recent losers rates will add about $9000 to how

of Melbourne, Hobart, Canberra and Sydney picking up as much a buyer on average earnings can

the booming cities of the last two years – Brisbane, Adelaide borrow which along with three further

and Perth – continue to slow as poor affordability impacts rate cuts into early next year will drive

them.

a significant increase in the capacity

of buyers to pay for a property.

positive for property because they take pressure off

existing homeowners who may have been struggling

with their mortgages leading to less distressed listings

and as they increase the amount a borrower can borrow

from a bank and hence pay for a property which supports

demand. Buyers know this and so rate cuts also provide a

boost to buyer sentiment and that is what we have most-

ly seen in improved auction clearances and now higher

prices so far this year. Roughly speaking the 0.25% rate

cut when passed on to variable mortgage rates will add

Source: CoreLogic about $9000 to how much a buyer on average earnings

can borrow which along with three further rate cuts into

The downswing just saw a 0.4% fall in national average early next year will drive a significant increase in the ca-

prices spread over 3 months, with falls in Hobart, Canberra, pacity of buyers to pay for a property. See the next chart

Melbourne, Darwin and Sydney partly offset by continued which also allows for wages growth over the year ahead.

gains in Brisbane, Adelaide, Perth and regional areas.

Source: RBA, CoreLogic, AMP

Source: CoreLogic, AMP • The rate cuts are also occurring against a backdrop of an

ongoing housing shortage which we have seen over the

Expect further gains in average property prices last few years provides a source of support for prices.

Further gains are likely as interest rates fall further and We estimate the accumulated housing shortfall to be

the shortage of property remains, provided unemployment around 200,000 dwellings at least, and possibly as high

doesn’t rise too far. The upswing is likely to be more appar- as 300,000 dwellings. It is likely to remain significant

ent through the second half as we see more rate cuts. for a while yet as building approvals running just above

• We expect three more RBA 0.25% rate cuts by early next 180,000 dwellings a year indicate that housing comple-

year – in May, August and February. Lower rates are tions are likely to run below government objectives for

2