Stepping back into the workforce

The life cycle of work has traditionally ended with retirement. Yet news of an emerging phenomenon suggests a growing trend towards ‘unretirement’ is turning the idea of retirement on its head. Making the decision to return to work is a significant one and, just like retiring, requires some consideration and planning.

Is returning to work as simple as it sounds?

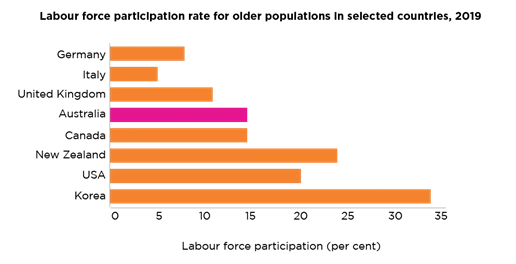

In Australia, older people have been deterred from re-entering the job market due to several reasons including age discrimination, erosion of pension income entitlements, perceived skills deficit, and lack of suitable jobs – just to name a few. This accounts for a lower workforce participation rate for people over 65 in Australia (15 per cent of the workforce) compared to some other countries such as New Zealand (24 per cent). But times may be changing.

Why are retirees going back to work?

Often, it’s not one factor in isolation but a range of factors that’s prompting the decision. A report by National Seniors Australia surveyed almost 4,000 people aged 50 and over about their perspectives on working after retirement. Around half (52 per cent) cited financial reasons with well-being and social factors also high on the agenda.

Financial well-being

For some retirees, particularly those relying on the aged pension, returning to work is a financial necessity with cost-of-living pressures a common precursor in recent times.

The Association of Superannuation Funds of Australia (ASFA) ‘Comfortable Standard’ suggests $70,806 per year is needed for a couple to live comfortably in retirement. For singles the amount is $50,207. The death of a partner, or other unexpected expense may be another precipitating factor. Self-funded retirees who had planned carefully for retirement may find themselves in need of additional income to support their later life.

If you’re contemplating a return to the workforce, it’s important to investigate the financial implications it may have on your super or pension before making the transition by seeking appropriate advice. Taking the middle road and opting for semi-retirement (where available) can be a good interim measure whether you’re moving from full-time work to retirement or vice versa.

Money isn’t the only reason retirees want to return to work. For some it’s a choice driven by the many other benefits associated with working.

Physical well-being

Pandemic aside, more people are living well from mid-life to older life, often bursting with a desire to “do more”. We’ve long been told about the health benefits of good work, and for good reason. Science tells us that continuing to learn and develop new skills is a protective measure against dementia and other diseases. Depending on the role, the routine of going to work helps to ensure mobility and physical activity, thereby supporting cardiovascular and bone health.

What happens to my super if I return to work?

This is not entirely straightforward with different conditions depending on your age. Special conditions of release apply to people below the age of 65, but for people aged 65 and above, their super can be accessed whether they are retired or not. This means that they can keep working (full or part time) or retire and re-enter the workforce later.

If I return to work, what will happen to my pension?

Relaxing the pension income test has been an ongoing debate with organisations such as National Seniors Australia calling for older Australians to be able to earn more before their pension entitlements are reduced. This issue was a focus of discussion at the Federal Government’s recent Jobs and Skills Summit aimed at addressing the nation’s current labour workforce shortage.

Pleasingly there was a positive outcome with the Albanese Government agreeing to relax the pension income test, boosting the income threshold from $7,800 per year to $11,800. The two-year time limited measure will also ensure retirees are not removed from Centrelink if they earn more than the fortnightly threshold across 12 continuous weeks.

Not yet retired? There are things you can do now to prepare for the retirement you want.

Educate yourself

It’s a good idea to develop a greater awareness on general financial well-being, in addition to retirement issues. ASIC’s website moneysmart.gov.au is a great place to start; you’ll find an excellent range of financial education-based resources, including tools like a budget planner and superannuation and retirement calculators.

Consider flexible working hours

Flexible working benefits all employees especially older workers who may not want the demands of working full time or have other commitments. And due to COVID-19, many organisations have now adopted flexible working policies which help to support the needs of older people.

Having the option to work fewer hours, or even part-time (semi-retirement), can be an appealing way for some to transition to full retirement.

Get the right advice if you need it

Google is no substitute for good retirement planning advice. Everyone has different goals in life and therefore, retirement planning can be very personal. Getting advice from a qualified financial adviser can help bring you closer to achieving the retirement you’ve always dreamt of.

Contact us for further information, we can help you map out a practical path to meet your goals as well as help you boost your super balance with tax-effective strategies.