Avoid passing bad money habits on to your kids

Generally speaking, we Australians are pretty financially savvy, that is, we understand the how and why of effectively managing our money. Unfortunately, that doesn’t mean we’re actually putting that know-how into practise and making astute financial decisions.

According to the Australian Bureau of Statistics (ABS), the average Australian household debt has risen by 7.3% (over $260,000) in the 2021-2022 financial year. As of July 2023, Australians were paying $18.4 billion – that’s billion with a B – in credit card interest every year.

As parents, we’re role models, integral to shaping our children’s values and beliefs. Like little sponges, they absorb our behavioural patterns, pick up on signals and mimic our actions.

For us to replace bad money habits with good ones may be a big ask, particularly as they’ve evolved over the course of our lives. But the trouble is that kids are a cluey bunch, eager to learn from us, and not surprisingly, our money habits are among many characteristics we unintentionally pass onto them.

Of course, we all want the best for our children. But in this busy world, we’re pulled in so many directions at once that sometimes it’s all we can do to juggle our daily work, family, school and social lives. Who has time to consider the inadvertent messages we could be giving out?

Yet, when it comes to ensuring our children are equipped to build themselves a secure financial future, it’s worth the effort, right?

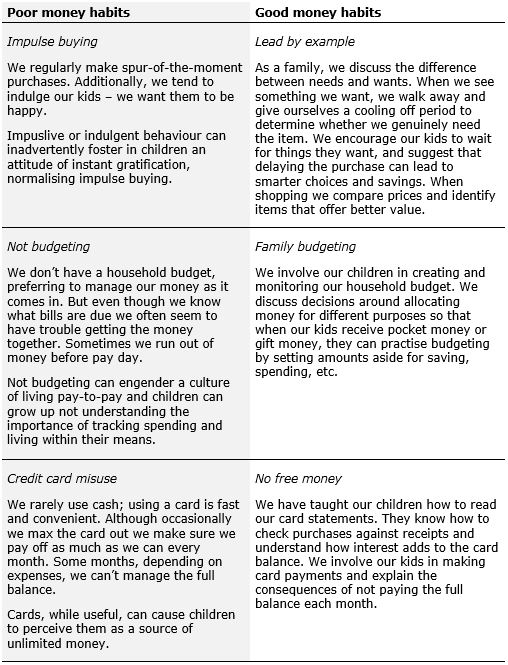

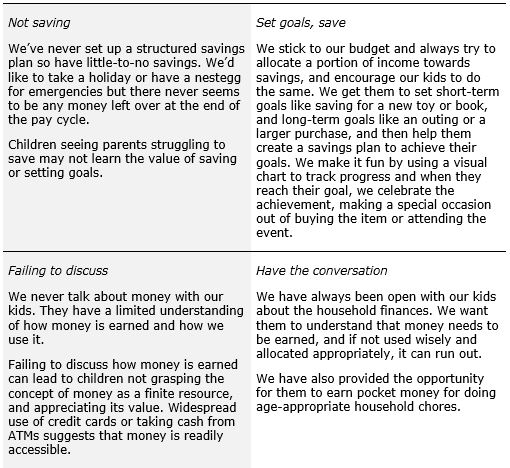

The table below shows a list of good and bad money habits that are commonly passed onto children.

If we can make time to examine the way we view and use money, and replace poor habits with good ones, we can positively influence our kids by:

- emphasising the importance of planning early in life,

- encouraging them to make informed decisions,

- empowering them to set goals and work towards achieving them.

As parents we have a limited opportunity to equip our children with tools like, knowledge, confidence and forward planning skills – before they decide they know more than us!

So, by modelling good financial behaviour ourselves, we can instil the habits that will set our children up for a life of financial freedom.

I don’t know about you, but if I can achieve that, I’ll know that I’ve done what I can to enable the next generation to succeed and thrive.

What a legacy!

Sources:

www.abs.gov.au “Average household debt grows by 7.3 per cent”, 13 December 2022.

www.finder.com “Australian credit card and debit card statistics” (accessed 25 September 2023)

www.moneysmart.gov.au “Teaching kids about money” (accessed 25 September 2023)