Tapping into your home’s equity

Retirees feeling the pinch of higher living costs, are reluctantly making difficult decisions as they draw dangerously close to outliving their retirement savings.

A 2021 report released by the Association of Superannuation Funds of Australia (ASFA) found that 90% of Australians who died aged over 80 years had no superannuation savings – an alarming statistic given that our average life expectancy is currently 83.6.

For many retirees, the family home remains their only asset. Not generally subject to capital gains tax, or assessable under the assets test, it represents financial security, independence and family history which is why downsizing is an unpopular option.

However, the family home also represents a reservoir of untapped equity.

Consequently, retirees are reviewing ways to access that equity through reverse mortgages or equity release schemes.

These arrangements provide access to some of your home’s equity, usually to cover medical costs, home renovations or even living expenses.

Now, here’s the fine print.

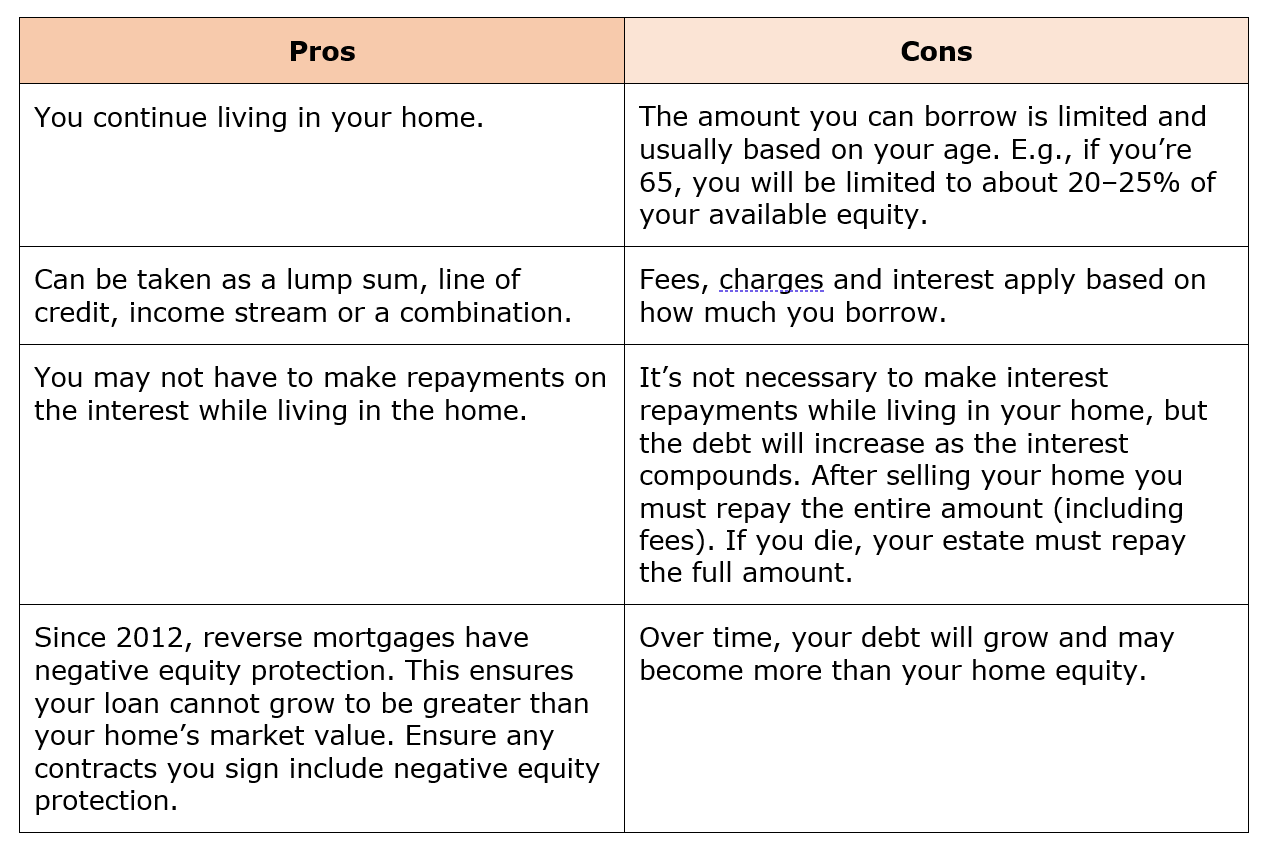

Reverse mortgage: borrowing money using the equity in your home as security over the loan.

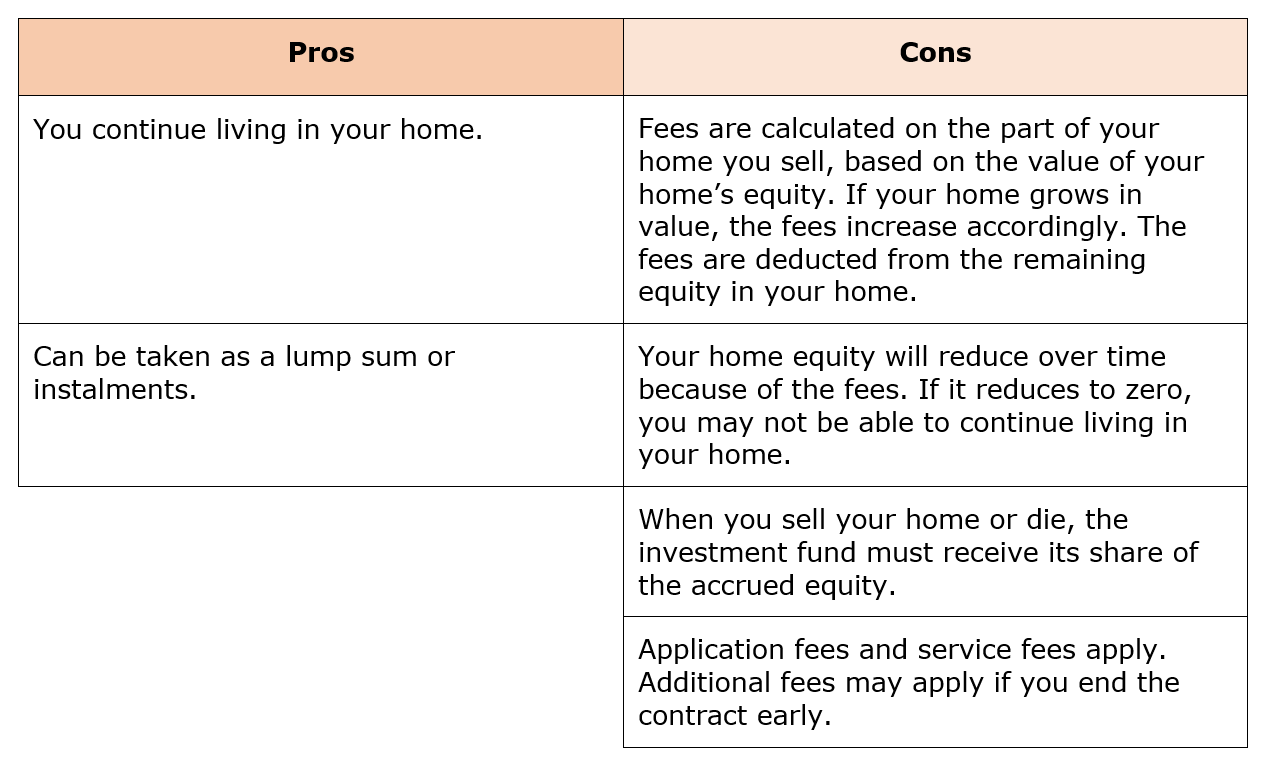

Equity release: selling part of your home through property investment funds.

Depending on your circumstances, either of these schemes may work for you. However, before making any decisions, consider these alternatives:

- Government no interest loans provide lump sums with no fees or charges. Visit the Good Shepherd Australia website for details.

- The Home Equity Access Scheme offers government backed assistance. See Services Australia or the Department of Veterans’ Affairs for information.

- Reconsider downsizing. The government offers incentives that may change your mind.

Regardless, get your financial adviser to run the sums for you. They’ll make sure your super savings are on track and you’re maximising your pension entitlements.

You’ve planned a busy retirement, so don’t let financial worries slow you down.

Sources:

www.superannuation.asn.au “Superannuation balances prior to death: Superannuation balances of older Australians”, ASFA, March 2021 (accessed 2 April 2023)

www.moneysmart.gov.au “Reverse mortgage and home equity release” (accessed 2 April 2023)

www.goodshep.org.au “No Interest Loans (NILs)” (accessed 2 April 2023)

www.servicesaustralia.gov.au “Home Equity Access Scheme” (Last updated 2 February 2023)