The long-term cost of taking $20,000 out of your super fund

If you have lost your job or are running out of money then accessing your super early may be tempting, but it’s important to understand the potential risks before you take that step. Here are three reasons you may want to think twice.

The outbreak of Coronavirus has seen massive numbers of workers lose their jobs around Australia. In a rapidly changing environment, Westpac’s chief economist, Bill Evans, recently predicted the unemployment rate could go as high as 11.1%. Thankfully, the situation is likely to be temporary. Mr Evans believes the employment market will bounce back towards the end of the year, with 350,000 jobs potentially coming on-line in the December quarter.

However, that’s not much consolation if you’ve just been laid off and fast running out of personal savings. At times like the present, the Federal Government’s early access to super initiative could offer a financial lifeline.

Accessing super early – the new rules

Under normal conditions, dipping into your super before retirement can only be done under strict conditions. These include compassionate grounds or financial hardship, which typically means you’ve been relying on social security benefits for at least six months.

But these are not normal times. If you’re experiencing financial stress, it’s now possible to withdraw up to $20,000 out of your super through two $10,000 payments: one before 30 June 2020, and another in the three months after 1 July 2020. The draw-downs are tax-free and the money won’t affect social security payments.

The Actuaries Institute estimates 1.35 million Australians could take up the option to withdraw $20,000 from their super, potentially siphoning $25 billion out of the nation’s retirement funds.

If you’ve just been laid off, the well-being of your super fund may be the least of your short-term worries. Even so, the decision to dip into your super early is something to think through carefully. It can impact your financial well-being in three key ways – potentially long after the Coronavirus outbreak has run its course.

1. Less money in retirement

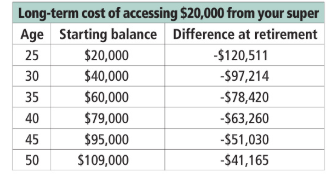

As you can see in the table below*, the younger you are, the greater the potential impact.

2. Your super’s investments may have taken a hit

Chances are, your super is invested in a “balanced” option, with up to 70% of your money invested in shares.

This strong weighting in shares reflects the potential for equities to earn decent returns over the long term.

However, recent weeks have seen share markets bathed in red ink. So, withdrawing at a time like this would mean ‘locking in’ any losses.

3. You could lose your life insurance

Accessing your super early could leave you without the protection of personal insurance keeping in mind that

a lump sum withdrawal from super – combined with regular fund fees and insurance premiums – could push

your account balance below $6,000. This benchmark matters because from 1 April 2020, default cover for life

insurance as well as TPD and income protection cover, could be automatically cancelled if you have less than

$6,000 in your super account. You will need to contact your superannuation fund to ‘opt-in’ and continue being

covered. If you do not contact them, you may find yourself uninsured should the worst happen – and you suffer a life-changing injury or illness.

If you decide to let your insurance lapse, there are no guarantees you’ll be able to opt back in later on, even

if your super savings grow above $6,000. You may need to provide medical details, and your application may be declined by the fund’s insurer.