Page 4 - Wall Street hammered! What now

P. 4

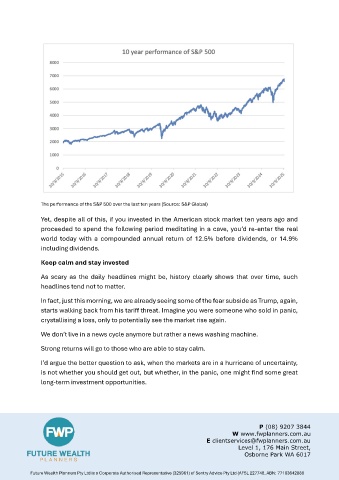

The performance of the S&P 500 over the last ten years (Source: S&P Global)

Yet, despite all of this, if you invested in the American stock market ten years ago and

proceeded to spend the following period meditating in a cave, you’d re-enter the real

world today with a compounded annual return of 12.5% before dividends, or 14.9%

including dividends.

Keep calm and stay invested

As scary as the daily headlines might be, history clearly shows that over time, such

headlines tend not to matter.

In fact, just this morning, we are already seeing some of the fear subside as Trump, again,

starts walking back from his tariff threat. Imagine you were someone who sold in panic,

crystallising a loss, only to potentially see the market rise again.

We don’t live in a news cycle anymore but rather a news washing machine.

Strong returns will go to those who are able to stay calm.

I’d argue the better question to ask, when the markets are in a hurricane of uncertainty,

is not whether you should get out, but whether, in the panic, one might find some great

long-term investment opportunities.

P (08) 9207 3844

W www.fwplanners.com.au

E clientservices@fwplanners.com.au

Level 1, 176 Main Street,

Osborne Park WA 6017

Future Wealth Planners Pty Ltd is a Corporate Authorised Representative (325961) of Sentry Advice Pty Ltd (AFSL 227748, ABN: 77103642888