Page 20 - Advice Matters - FWP May 24

P. 20

Connecting an adviser with your children

How parents and advisers can work together to power of advice lies: its ability to transform families by building

manage intergenerational wealth transfers. intergenerational wealth.

We’re told our time horizon shrinks as we age. This makes sense, The intergenerational wealth opportunity

because the closer we get to retirement, the less time we have Australia is nearing the crest of a retirement wave. As the baby

left to accumulate wealth. And the nearer we come to having to boomer generation looks to pass on wealth, those in receipt of

eventually draw down on that wealth. it will likely need guidance.

But retirement often throws up a whole new set of priorities. For the emerging generation of wealth builders, what were once

Instead of our own time horizon, we’re now thinking about reasonably straightforward considerations around saving and

our children’s time horizon; and, as they may have their own budgeting may suddenly become more substantial.

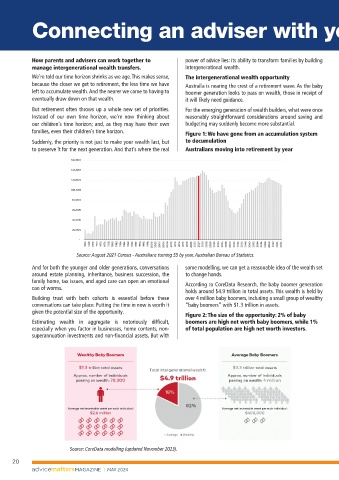

families, even their children’s time horizon. Figure 1: We have gone from an accumulation system

Suddenly, the priority is not just to make your wealth last, but to decumulation

to preserve it for the next generation. And that’s where the real Australians moving into retirement by year

Source: August 2021 Census - Australians turning 55 by year, Australian Bureau of Statistics.

And for both the younger and older generations, conversations some modelling, we can get a reasonable idea of the wealth set

around estate planning, inheritance, business succession, the to change hands.

family home, tax issues, and aged care can open an emotional According to CoreData Research, the baby boomer generation

can of worms.

holds around $4.9 trillion in total assets. This wealth is held by

Building trust with both cohorts is essential before these over 4 million baby boomers, including a small group of wealthy

conversations can take place. Putting the time in now is worth it “baby boomers” with $1.3 trillion in assets.

given the potential size of the opportunity.

Figure 2: The size of the opportunity: 2% of baby

Estimating wealth in aggregate is notoriously difficult, boomers are high net worth baby boomers, while 1%

especially when you factor in businesses, home contents, non- of total population are high net worth investors.

superannuation investments and non-financial assets. But with

Source: CoreData modelling (updated November 2023).

20

MAY 2024