Page 11 - Advice Matters - FWP May 24

P. 11

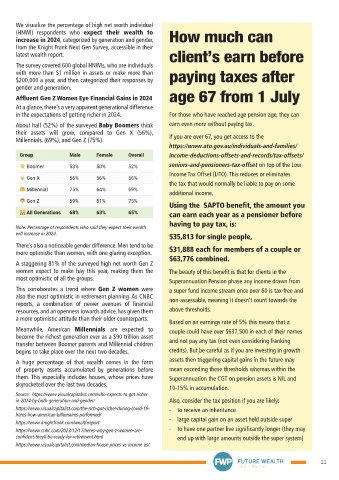

We visualize the percentage of high net worth individual

(HNWI) respondents who expect their wealth to How much can

increase in 2024, categorized by generation and gender,

from the Knight Frank Next Gen Survey, accessible in their

latest wealth report. client’s earn before

The survey covered 600 global HNWIs, who are individuals

with more than $1 million in assets or make more than paying taxes after

$200,000 a year, and then categorized their responses by

gender and generation.

Affluent Gen Z Women Eye Financial Gains in 2024 age 67 from 1 July

At a glance, there’s a very apparent generational difference

in the expectations of getting richer in 2024. For those who have reached age pension age, they can

About half (52%) of the surveyed Baby Boomers think earn even more without paying tax.

their assets will grow, compared to Gen X (56%),

Millennials, (69%), and Gen Z (75%). If you are over 67, you get access to the

https://www.ato.gov.au/individuals-and-families/

income-deductions-offsets-and-records/tax-offsets/

seniors-and-pensioners-tax-offset on top of the Low

Income Tax Offset (LITO). This reduces or eliminates

the tax that would normally be liable to pay on some

additional income.

Using the SAPTO benefit, the amount you

can earn each year as a pensioner before

having to pay tax, is:

Note: Percentage of respondents who said they expect their wealth

will increase in 2024.

$35,813 for single people,

There’s also a noticeable gender difference. Men tend to be $31,888 each for members of a couple or

more optimistic than women, with one glaring exception.

$63,776 combined.

A staggering 81% of the surveyed high net worth Gen Z

women expect to make hay this year, making them the The beauty of this benefit is that for clients in the

most optimistic of all the groups. Superannuation Pension phase any income drawn from

This corroborates a trend where Gen Z women were a super fund income stream once over 60 is tax-free and

also the most optimistic in retirement planning. As CNBC non-assessable, meaning it doesn’t count towards the

reports, a combination of newer avenues of financial

resources, and an openness towards advice, has given them above thresholds.

a more optimistic attitude than their older counterparts.

Based on an earnings rate of 5% this means that a

Meanwhile, American Millennials are expected to couple could have over $637,500 in each of their names

become the richest generation ever as a $90 trillion asset

transfer between Boomer parents and Millennial children and not pay any tax (not even considering franking

begins to take place over the next two decades. credits). But be careful as if you are investing in growth

A huge percentage of that wealth comes in the form assets then triggering capital gains in the future may

of property assets accumulated by generations before mean exceeding these thresholds whereas within the

them. This especially includes houses, whose prices have Superannuation the CGT on pension assets is NIL and

skyrocketed over the last two decades.

10-15% in accumulation.

Source: https://www.visualcapitalist.com/who-expects-to-get-richer-

in-2024-by-both-generation-and-gender/ Also, consider the tax position if you are likely:

https://www.visualcapitalist.com/the-rich-got-richer-during-covid-19- - to receive an inheritance

heres-how-american-billionaires-performed/

https://www.knightfrank.com/wealthreport - large capital gain on an asset held outside super

https://www.cnbc.com/2023/12/17/heres-why-gen-z-women-are- - to have one partner live significantly longer (they may

confident-theyll-be-ready-for-retirement.html end up with large amounts outside the super system)

https://www.visualcapitalist.com/median-house-prices-vs-income-us/

11